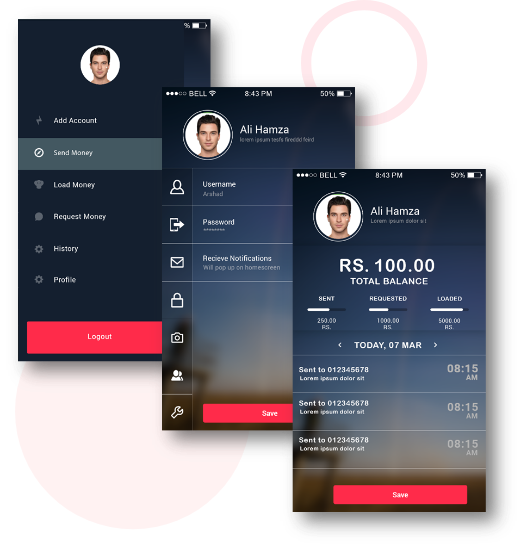

A Complete Mobile Financial Service Suite.

A Mobile Financial Service suite that offer a complete range of products that enables service providers to deliver extensive financial services to the unbanked,

- Manages the entire mobile money eco-system through comprehensive interfaces for different system actors

- Extensive products, features, limits and KYC configurations

- Supports closed-loop, semi-closed and open-loop models

- Allows the creation of distribution chain and commission hierarchies

- Integrated financial middleware allows integration with Financial Entities and External Application for service aggregation

- Transaction Channel (USSD, Mobile Web, Native Apps, Web and APIs)

- Prepaid Cards Inventory and Distribution Management

- Social and e-Commerce integration

- Integrated CRM, CMS, Workflow and Document Management